Bananas. Tomatoes. Coffee. Anything that comes in a can.

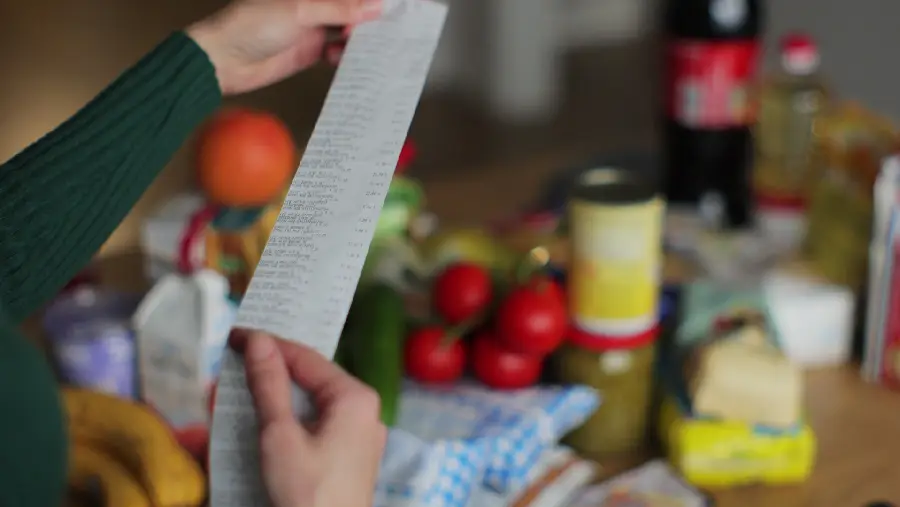

These are among the products that consumers can expect to cost more in the months ahead as the impact of new global tariffs is felt.

Some of these higher prices are already here. Coffee rose 2.2% in June and overall fruits and vegetables went up 0.9% over the past month, according to the latest inflation numbers from the Bureau of Labor Statistics.

Yet for the first half of the year, inflation for food at home was fairly flat, rising 0.3% overall in June after going up 0.3% in May, dropping 0.4% in April, staying put in February and rising 0.5% in January and March. This past month, egg prices – which had reached record high levels – dropped 2.7%. Additionally, prices fell for meat, poultry, fish and dairy, as well as cereal and bakery products.

Looking ahead, tomatoes are due for a hit, as this month heralded a 17% duty on tomatoes from Mexico, which supplies about 70% of the fresh product consumed in the United States. Meanwhile, tariffs on aluminum and other packaging materials are expected to drive up the cost of canned goods.

What does this mean for grocery retailers?

Pressure continues to increase on them to hold the line on food prices at the shelf, to deliver consumers the best value they can while contending with rising costs on almost every other aspect of doing business, front and back of house.

Consumers are more price-sensitive than ever, so retailers face a significant challenge to secure and maintain shopper loyalty and trust. If consumers feel they’re not getting a fair deal on those items they buy most often – staples like bread, milk, eggs, butter, bananas and toilet paper – they’re likely to switch stores and not come back.

How do your prices stack up against your competitors on those Key Value Items?

RDSolutions’ monthly Retail Pricing Insights Report shows who’s leading and lagging in nine key U.S. regions. Side-by-side indices reveal geographic price differences, category-level inconsistencies and emerging trends by product type, offering a clearer view of competitive positioning across the country.

How do you measure up?